Has COVID catalysed the digital transformation of the remittance industry? November 13, 2020

COVID-19 has fundamentally changed a lot this year. In the case of the money transfer industry, the immediate impact has not been a positive one. The World Bank has predicted that global remittances are set to decline by 20% as a direct result of the pandemic. Something needs to be done and it’s the young and nimble money transfer operators (MTOs) that are best equipped to create a new digital path in a world where physical contact is restricted.

The evidence of digital transformation

Digital transformation has been slowly changing the remittance sector for decades now and COVID has hastened that transformation. The fact is, where digital was once an option it’s now a necessity and that has completely changed the game for all banking sectors.

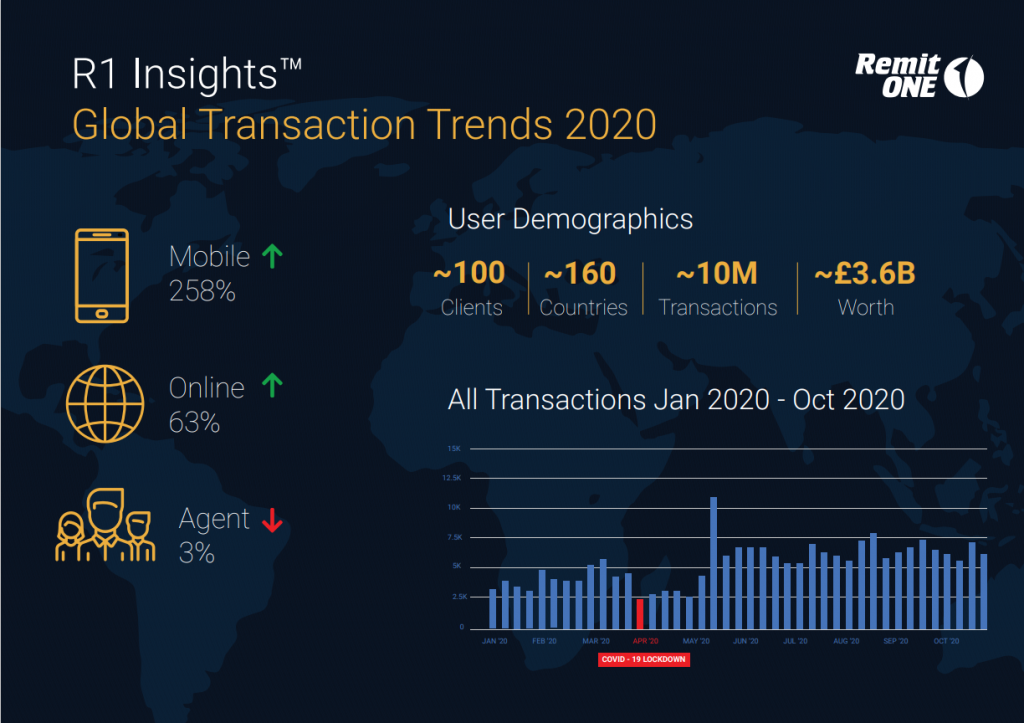

According to recent RemitONE transaction data trends, there has been a major acceleration of digital channel use during the pandemic. The use of physical agents, meanwhile, is down, which might seem insignificant but points to a drastic overall shift in consumer habit.

Throughout history, it’s the sectors that have been able to adapt to the times that have weathered the storms and retained their relevance. With the recession caused by COVID-19 taking a toll on the ability to send money home and remittance flows projected to decline even further by 14% in 2021, an easier, cheaper remittance solution has never been more vital.

Digital money transfer

Studies have proven that remittance not only helps to alleviate poverty in developing countries but can also lead to an increase in domestic spending. If there’s one thing we need right now it’s for people to be spending more. Digital-first MTOs are the ones ready to offer the most robust and accessible easy-to-use remittance services with fair and reliable exchange rates.

Of course, this is not a change that can happen overnight. Historically speaking, migrant communities would rely on physical money transfer services and these services have, as a result, become pillars of the community. Indeed, it’s estimated that the recipients of many international remittances are unbanked, which might go some way towards explaining why 90% of remittances currently begin and end with cash.

Does this mean it’s up to remittance operators to prove their worth and make themselves more accessible? Because digital operators that use the latest remittance software are not faster and only more affordable due to the obvious lack of overheads but have been proven to be better at evaluating customer experience and security.

Digital acceleration beyond the pandemic

It’s no exaggeration to suggest that COVID-19 changed the world overnight, but the impact on the migrant community has been under-reported. For months now, foreign travel has been almost impossible, which means migrant families have been unable to visit their families. What’s more, the pandemic has amplified the pressures migrants face in striking a balance between supporting themselves and supporting their families back home. For these families, digitally native money transfer operators will play a crucial role in redefining remittance and money transfer for a post-COVID world.

There are several benefits of digital transformation for the remittance sector for both legacy and upstart operators. Through the use of money transfer software on desktop computers and via smartphone apps, it’s never been easier and faster for customers to keep a reliable track of their remittance journey. The pandemic might have offered an opportunity for operators to use this software to foster trust and build new customer bases that keep communities connected and able to hold each other up.

This is proven by the growth of M-Pesa as the predominant payment method in Kenya. This is a digital solution that manifested because a traditional banking ecosystem was simply not accessible for a majority of Kenyans. That digital alternative quickly became the preferred option when users realised how powerful, easy, and convenient it was. Ultimately, it’s a safer, faster, and easier service that should help shoulder some of the stress that migrant families currently find themselves under.

Conclusion

Consumer preference has been shifting away from cash for years now and with many cash-based remittance solutions forced to close due to COVID-19, the future is definitely in digital. What money transfer operators and other fintech organisations need to understand is that this represents an incredible opportunity for them to prove their worth.

Borders might be closed but migrant workers still depend on remittance and if they’re going to make that switch from their old inflexible and outdated conventional means to more accessible solutions, they might need a bit of a gentle push.

To discuss your online offering with our team of experts please contact marketing@remitone.com

Related Posts

-

Q&A with Industry Experts: Ibrahim Muhammad

In our interview, Ibrahim reviews the compliance and regulation requirements companies need in order to start, maintain and grow a Money Service Business (MSB).

November 14, 2022 -

Innovation in Payments and Remittances (IPR) Awards 2022

RemitONE is thrilled to announce the winners of the 2022 Innovation in Payments and Remittances (IPR) Awards. The IPR Awards are a celebration of the money transfer community and the achievements of the industry’s best and brightest.

November 14, 2022 -

RemitONE presents Innovation in Payments and Remittances (IPR) Global 2022

RemitONE is pleased again to bring to our great industry the Innovation in Payments and Remittances (IPR) Global event at The Westin Hotel, London, UK, from Wednesday 19 to Thursday 20 October 2022.

June 29, 2022 -

Q&A with Industry Experts: Saiful Alom

In our interviews, Saiful offers insights into the challenges facing MSBs, banks and agents in the money transfer industry.

June 24, 2022 -

Open Banking and Payment Innovation

Based on the use of Application Programming Interface (API) technology – and initiated by PSD2 in 2016, the Open Banking movement allows banks to make their customers’ financial data shareable and enables third parties to access real-time financial information.

April 27, 2022 -

Preguntas y respuestas con expertos de la industria: Selim Mohamdi

En nuestra entrevista, Selim explora la relación entre la aceptación de los pagos móviles y lo que esto significa para las transferencias de dinero en efectivo, así como el papel de las criptomonedas y blockchain en el proceso de remesas.

April 7, 2022